Fed Funds Rate: Higher for Longer?

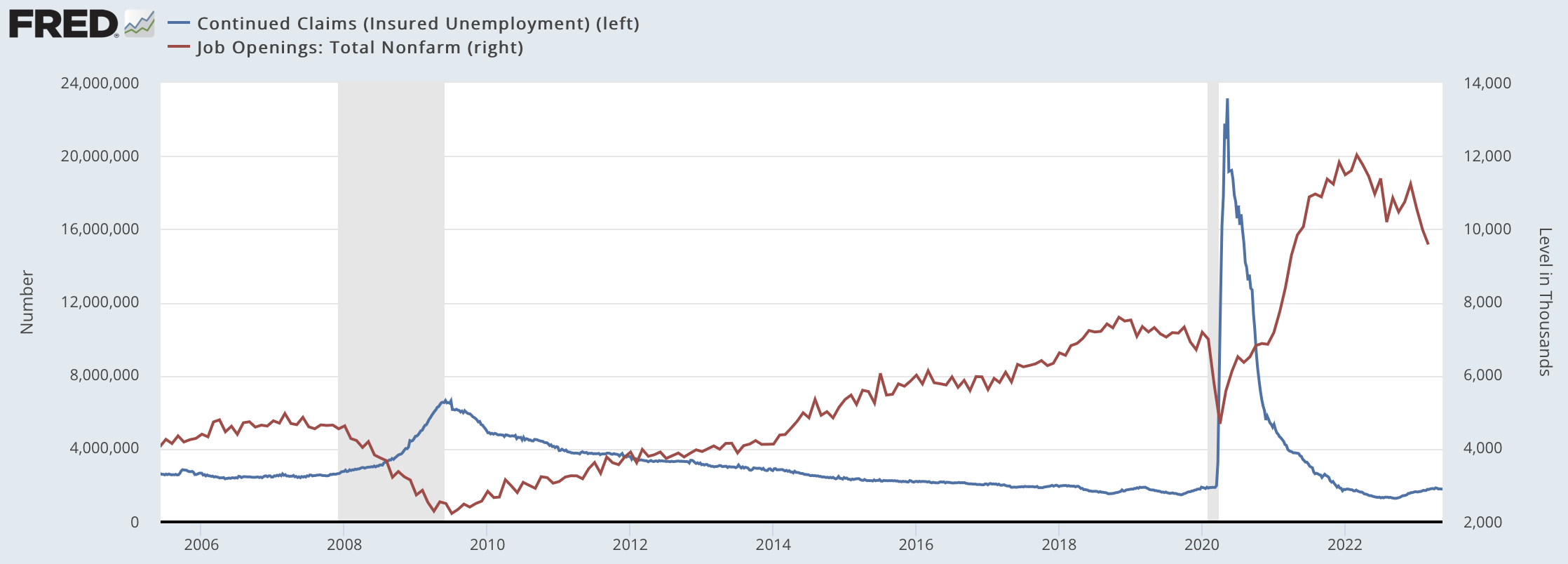

Job Openings and Continued Claims

- The Federal Reserve is likely to maintain higher rates for longer than the market is anticipating due to the continued strength in the labor market.

- The market is currently pricing in two rate cuts by the end of this year.

- The labor market is starting to show signs of easing. It has remained resilient despite economic headwinds.

- The supply-demand imbalance for labor continues to be a driving factor contributing to persistent inflationary pressures.

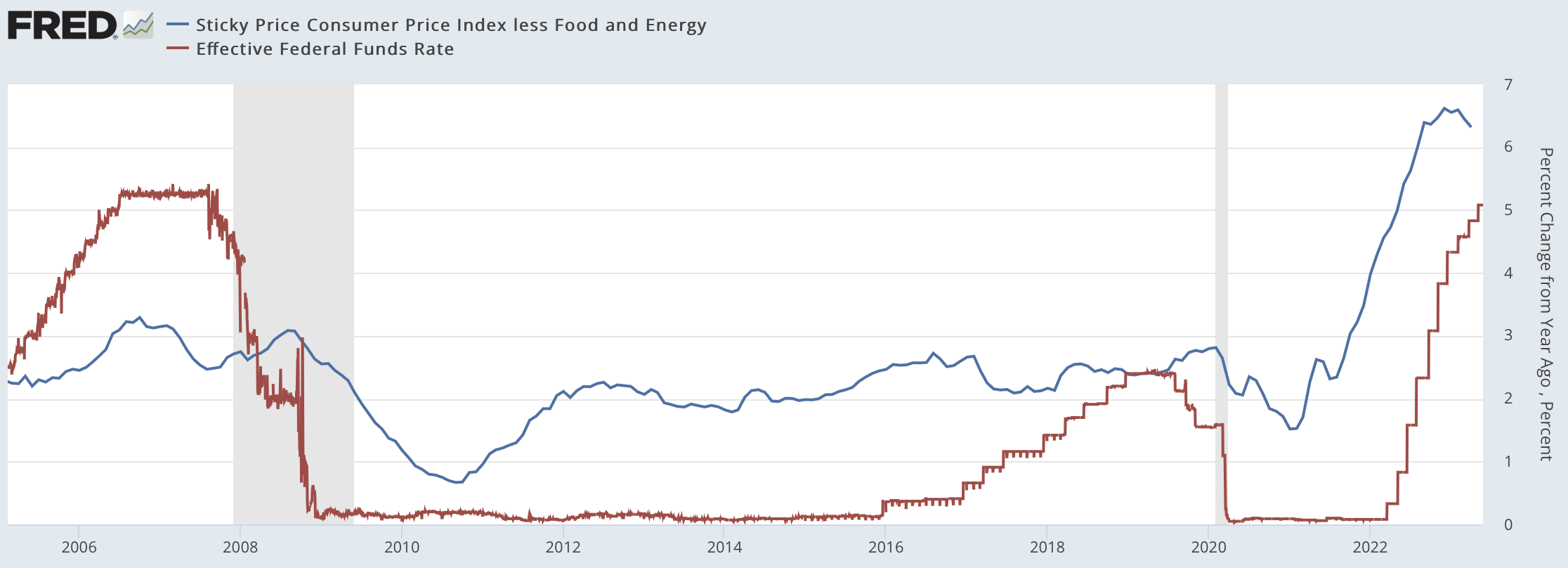

CPI and Effective Federal Funds Rate

- The Sticky Price CPI (blue line) tracks a subset of goods and services that change price infrequently. Insurance, healthcare, and food away from home are a few examples of inputs.

- CPI has come off the highs but remains far from the Fed's 2% target.

- As you can see, during the 2008 Financial Crisis, the Fed could quickly lower rates (red line) when economic conditions deteriorated since inflation was not an issue.

- The Fed might be stuck between a rock and a hard place on rate policy direction if economic conditions deteriorate and inflation remains well above their 2% target.

The dynamics in the labor market suggest that the Fed has no significant reason to cut rates. Near full employment and excess cash in the system continue to fuel consumer spending. We will observe the incoming data on these conditions as the past 12 months of rate increase continues to work their way into the economy. While intermediate and long duration credit is becoming more attractive, until the data suggest otherwise, we are continuing to favor short duration credit.

Resource Links:

The opinions expressed are for informational purposes only and should not be considered advice; individual circumstances may vary, seek professional guidance before making any financial decisions.